Scarcity, knowledge, and scale

Anyone who thinks you can escape scarcity in a finite world is either mad or not an economist

How much cheaper can solar panels get?

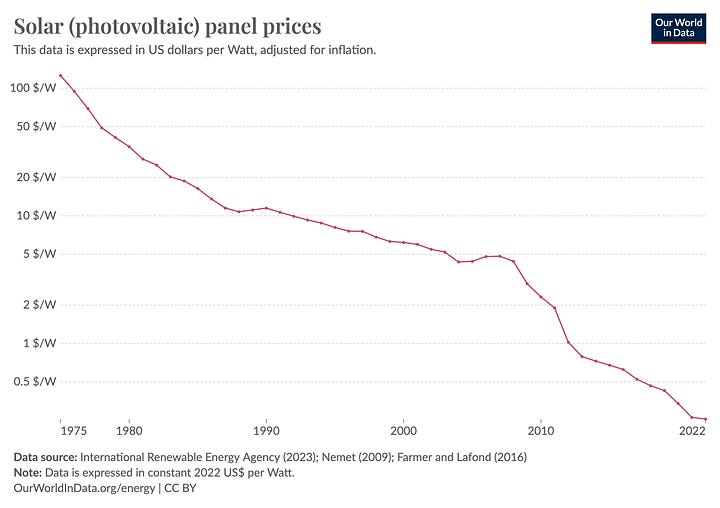

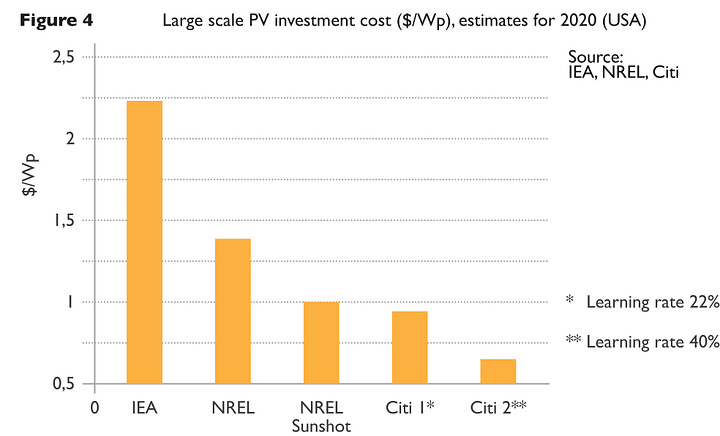

This is an important question. While not the only factor, the cost of generating solar energy is an important factor in how much solar energy gets produced. Accurate cost projections can lead to better capital allocation and a faster energy transition. It’s not news to say that in the recent past the International Energy Agency (IEA) has consistently overestimated the cost of solar panels, and consequently underestimated their deployment. Just compare the empirical trend against the IEA’s 2012 prediction of 2020 costs. By 2020, the global average cost was around 0.34 $/W. The IEA’s 2012 prediction was around 2.2 $/W — nearly 10x higher. Even the lowest estimate, from Citi, was about 0.65 $/W — around 2x higher.

(“How much cheaper can solar panels get” is an important question but not what I’m getting after in this post. No answers here. Sorry.)

The IEA’s misses point to a broader question: how do we estimate what something will cost as its production scales up? If you dig into this you’ll find people talking about something called “learning curves”, with specific assumptions about “learning rates” driving much disagreement between predictions. At a high level, learning curves assert that the cost of producing one unit of a thing will fall as the number of things produced increased. Cost estimation using learning curves is often described as something of an art, requiring a good deal of expert judgement. It often doesn’t work in places where it seems it ought to. But where it works, it seems to work well.

Why do learning curves apply in some cases and not others?

Wright’s Law

The basic idea of a learning curve is that the relationship between unit costs1 and the scale of production is a power law function of the form

where C(1) is the cost of the first unit, x is the cumulative volume of production, and a is the elasticity of cost with respect to output. As far as I’m aware this idea first appears in a very readable 1936 article, “Factors Affecting the Cost of Airplanes”, by T.P. Wright.

Wright labels his figures with “average costs”. But much of the exposition refers to factors affecting marginal costs. When factors affect marginal costs they must of course affect average costs; the reverse is not necessarily true. Here, however, we want to be precise: the “true” learning curve effects, the ones we ought to care about, affect marginal costs.

(Only changes in marginal costs will affect your total costs and at the end of the fiscal year, you can only keep the difference between your total revenues and your total costs. Average total costs are a useful accounting device but are not the underlying economic control surface.)

Wright’s taxonomy

Wright groups the sources of learning curve effects by where they occur. I’ve further filtered down to “true” learning curve effects — things that cause marginal cost curves to decline with production scale.

Labor: As production scales up, workers gain practice and proficiency and spend less time on each unit.2 At higher production scales, a firm can also justify investing in better tooling and benefit from standardization, which further reduces the time a worker must spend on each unit.3 Better tooling and standardization, in turn, can allow the firm to use less-skilled labor and reduce the wage bill.4

A buyer purchasing 10000 units may also be less likely to submit changes to their orders than a buyer purchasing 100 units, resulting in fewer changes to disorient workers. This type of effect on the buyer may be worth considering a type of learning curve effect in labor since it addresses marginal costs. I am excluding it only as a matter of convention, to focus on what is directly in the firm’s control.

At 10000 units the time to set up the machines and tooling can be amortized over more output than at 100 units. This is not a true learning curve effect; such amortization is “only” an accounting maneuver. Accounting maneuvers have their place but they are not going to directly affect the firm’s economic profits.

Material: At larger scales, practice will lead to less wastage on the production floor — labor effects manifesting in material use. Factor input costs will also decrease as suppliers are able to produce more efficiently — labor effects manifesting in the supply chain.

A firm producing a large run may also receive discounts from its input suppliers. Whether this reflects a true efficiency gain or not depends. It may be that the input supplier has lower costs due to their own learning effects (in which case this is simply passthrough of an effect already described), or it may be something else like “the input supplier values certainty of demand and is offering a discount to incent it” (not really a learning effect).

Overhead: Whereas in regard to labor and material Wright offered specific mechanisms, here he just notes that it seems to decrease with scale and would likely increase after some point.5

It’s notable to me that unlike labor and material, Wright admits to not understanding overhead and speculates it would likely increase after a certain point. This pattern is easy to see with Miles Kimball's replication argument: absent the ability to perfectly replicate individuals, managerial talent/administrative capacity are scarce factors, and overhead is often driven by management and administration.

Learning curves are people

It should be clear from the descriptions that the learning curve effects are largely about the specific people involved in production.

Imagine if every 100 units, every person in the factory was replaced with a brand new person who had never set foot in the factory before. Under such conditions how much of the aforementioned labor savings will materialize? What kind of material use efficiency will a forever-new workforce deliver, and how effectively can they use more sophisticated tooling? Should such conditions apply to the suppliers of your inputs, how much will you really gain from submitting large orders? Knowledgeable people are scarce, and these conditions won’t reduce their scarcity.

(I am distinguishing between “information” — an abstract set of facts or data points — and “knowledge” — concrete insights specific to a place, time, and process. Information can be freely (or at very low cost) copied and disseminated. Knowledge cannot. This point is central to Hayek’s arguments about markets in “The Use of Knowledge in Society”. The extent to which knowledge can be transmitted between people varies across settings but, as any teacher or student can attest, as a general rule knowledge transmission is costly and imperfect.)

Wright recognized this fact:

Considerable judgment is necessary when applying the curves here developed to succeeding orders of the same airplane. Consideration must be given to the changes introduced between these orders and, as well, the lapse of time which occurs. It is obvious that new setups; re-establishment of tools; labor turnover between orders; necessity for making new purchases; all contribute towards higher costs for the second order than would maintain if it were combined at one time with an earlier one. Judgment must therefore be used in selecting the proper factor when estimating the costs for such succeeding order.

Even under conditions of the 100-person-replacement thought experiment you may gain some efficiencies from better tooling. But should the replacement be accompanied by a significant stretch of time, enough for the tooling to degrade or be needed elsewhere you may not gain even that. Later, Wright attributes increases in unit costs (cast as dollars per pound of airplane produced — an interesting parallel with the $/kg metric favored in space) faced by government orders in part to inspections which disrupt the smooth functioning of the factory. Uninterrupted time is also scarce.

Everything is eventually scarce

Wright's law describes costs as a decreasing function of quantity. His exposition suggests factors which may increase costs with quantity — factors which may reasonably be described as kinds of scarcity — but his parameters and plots indicate he thinks the decreases outweigh the increases. Economists prefer to describe costs as increasing functions of quantity. We prefer to think of the increases outweighing the decreases. Why?

To an economist, scarcity is a fundamental force in human affairs. It’s less an empirical argument and more an organizing principle or spherical cow: it’s not that it's right, it's that thinking about it can help you understand things that weren’t obvious before. In the case of production, thinking about scarcity can help you see what you need to scale efficiently.

Consider a typical production line thought experiment used to teach decreasing returns to scale in an introductory microeconomics class:

Suppose you are selling creemees (soft-serve ice creams). To start, there is one creemee machine, one checkout register, and two workers. One worker is taking orders and passing them to the other who operates the machine, and then running to the register to ring the customer up. Suppose you add one worker without adding another machine or register. Now we can specialize between taking orders, operating the machine, and ringing customers up. We have increased output per unit time. Add another worker. They can help keep the machine stocked and reduce downtime, again increasing output per unit time. Add another worker. They can help the worker stocking the machine or give another worker a break, again increasing output per unit time. At some point when we keep adding workers the incremental gain in output per unit time will decrease; it may even become an incremental loss at some point. Why?

The point of this exercise is to get students thinking about what is or isn't scarce. There are only so many things for a worker to do on a given order. There is only so much area in the shop to not be underfoot. There are only so many orders to be serviced per unit time. The details may vary a bit with the specifics of the example, but the point is the same: illustrating how some sort of bottleneck — some sort of scarcity — generates decreasing returns to scale.

Interestingly, Wright’s Law doesn’t really seem to be emphasized much in economics education. I’m pretty sure I never saw it in undergrad or grad school; though “learning-by-doing” came up every so often, I don’t remember any systematic treatments. By contrast, discussion of Wright’s Law seems very common in engineering settings.

Learning curves apply when scarcity doesn’t constrain

Wright’s Law, then, is perhaps an argument about a different kind of scarcity: the scarcity of knowledge. The insights and experience that can make production more efficient — what I termed “knowledge” rather than mere “information” — only accumulate by actually producing. Producing at larger scales can also justify investing in better tooling, and the accumulation of knowledge can itself inform selection and design of “better” tooling. Knowledge is qualitatively different from “physical” inputs like worker-hours or material: whereas physical inputs start off abundant and can become scarcer over time, knowledge starts off scarce and can become more abundant over time.

As long as the conditions for producing large quantities in a relatively short window of time with substantial overlaps between workers today and workers tomorrow — ample demand for the finished product, a relatively large workforce, readily-available supplies, etc. — are satisfied, knowledge will continue to accumulate and Wright’s Law will apply. Costs6 will fall and the question becomes how fast, i.e., how to determine the learning rate7. When these conditions are disrupted and scarcity binds, costs will cease to fall. The typical cost functions of basic microeconomic theory (convex increasing curves) describe cases where scarcity binds. In these cases, increasing the scale of production will increase costs rather than decrease them.

Let’s return to renewable energy to think about scarcity and where Wright’s Law may or may not apply. This discussion between David Roberts and Doyne Farmer suggests they don’t think scarcity will constrain solar panel production in the near future, and indeed solar panels have been a great example of learning curve effects. All the conditions seem to be met and don’t seem likely to break in the near future.

Farmer contrasts solar panels with small modular nuclear reactors, arguing “just because you make them in a factory, doesn't mean that Wright's Law is going to hold”. Why? Because the cost advantage of other generating sources — including big nuclear reactors — means demand for small reactors will be scarce, and thus relevant knowledge will remain scarce. If I’m right, Wright’s Law could apply to small modular reactor production if consistent demand for those reactors emerged (e.g., if governments decided they were a strategic technology area). Absent such demand, reactor factories won’t quickly produce a lot of people with knowledge of modular reactor production and so won’t drive down modular reactor costs.

The same idea can be applied elsewhere. For example, to the extent that scarce demand for launches keeps marginal launch costs high, the consistent demand Starlink provides is a significant benefit to SpaceX’s launch operations. Starlink enables SpaceX to conduct many launches in a relatively short window of time with workers accumulating knowledge of the processes relevant to launching and refurbishing rockets. This has likely driven their marginal cost per launch lower over time, though the magnitude is unclear, depreciation and the rate of return on satellites will affect overall profits, and their prices may not reflect their costs. To the extent they are demand-constrained, other launch providers may not similarly benefit from Wright’s Law and the accumulation of knowledge.

It’s unclear whether Wright meant marginal costs or average total costs. But the relevant notion is marginal, not average total.

Such effects have been found across fields, and may have some neurological basis in the memory and algorithmic processes of workers involved, e.g., cigar rolling.

This indicates optimization over fixed/marginal dimensions: by spending more on the fixed one shifts the marginal curve lower. The trade-off is implied. There's no reason one couldn't set up tooling and standardization for even a small production run if it was costless. That it requires a larger run indicates otherwise. This is qualitatively similar to the emergence of property rights described in Demsetz (1967).

This may be reversed in a labor market that is small relative to the scale of production in that eventually, scarcity will bid up wages. It could occur in the short run to bring more “close” workers into the market, and over the long run to induce more “production of workers”. It need not occur at the level of all individual firms; it is enough that competitive forces drive it to occur in the aggregate along the cross-section of firms.

Direct quote, emphasis mine: “The overhead, or burden, varies, within limits, with quantity. The exact amount fluctuates greatly for different cases, depending, for example, on whether a particular factory is engaged in the manufacture of one type of plane or of many types. The following relationship shows for one particular factory the type of overhead variation which maintains. When this factory was employing five hundred workmen, the overhead ran one hundred percent; at one thousand workmen, this was reduced to seventy-five percent; and at fifteen hundred workmen to sixty percent. It is probable that the curve would flatten out above that amount and then, in very large quantities, increase in amount. In combining factors of labor, material, and overhead to determine a suitable curve for direct application to the whole airplane, a figure of seventy percent for overhead has been used in this paper.”

Costs, not prices. Whether prices track costs or not is a question of market structure. Solar panel producers tend to operate in fairly competitive markets, so prices are driven toward costs. Wright’s Law is not directly about prices.

I don’t know of economic research microfounding learning rates or supporting such microfoundations econometrically, but I would be very interested if any readers have pointers.